- This loan is granted to support businesses in terms of working

capital, manufacturing funding, asset acquisition, project

funding etc - Intended borrower must have been in current business for at least

two (2) years. - Security in the form of land, landed property or vehicle in the custody of the union shall be required

- Business registration certificate shall be required

- Post–dated cheques to cover full repayment of the loan

- Maximum loan processing period of 10 working days

- Loan shall be repaid at least once a month

Document required - Business registration document including certificate of

incorporation, certificate to commence business, company

regulations, partnership Deed etc, - Company profile

- Identity and proof of address of Directors

- Bank statement for the past six(6) months

- Two years audited accounts

- Cash flow projections

- Copy of Contract (if any)

- ECOWAS Identification card of sole proprietor / managing

Director) - Original Documents on collateral

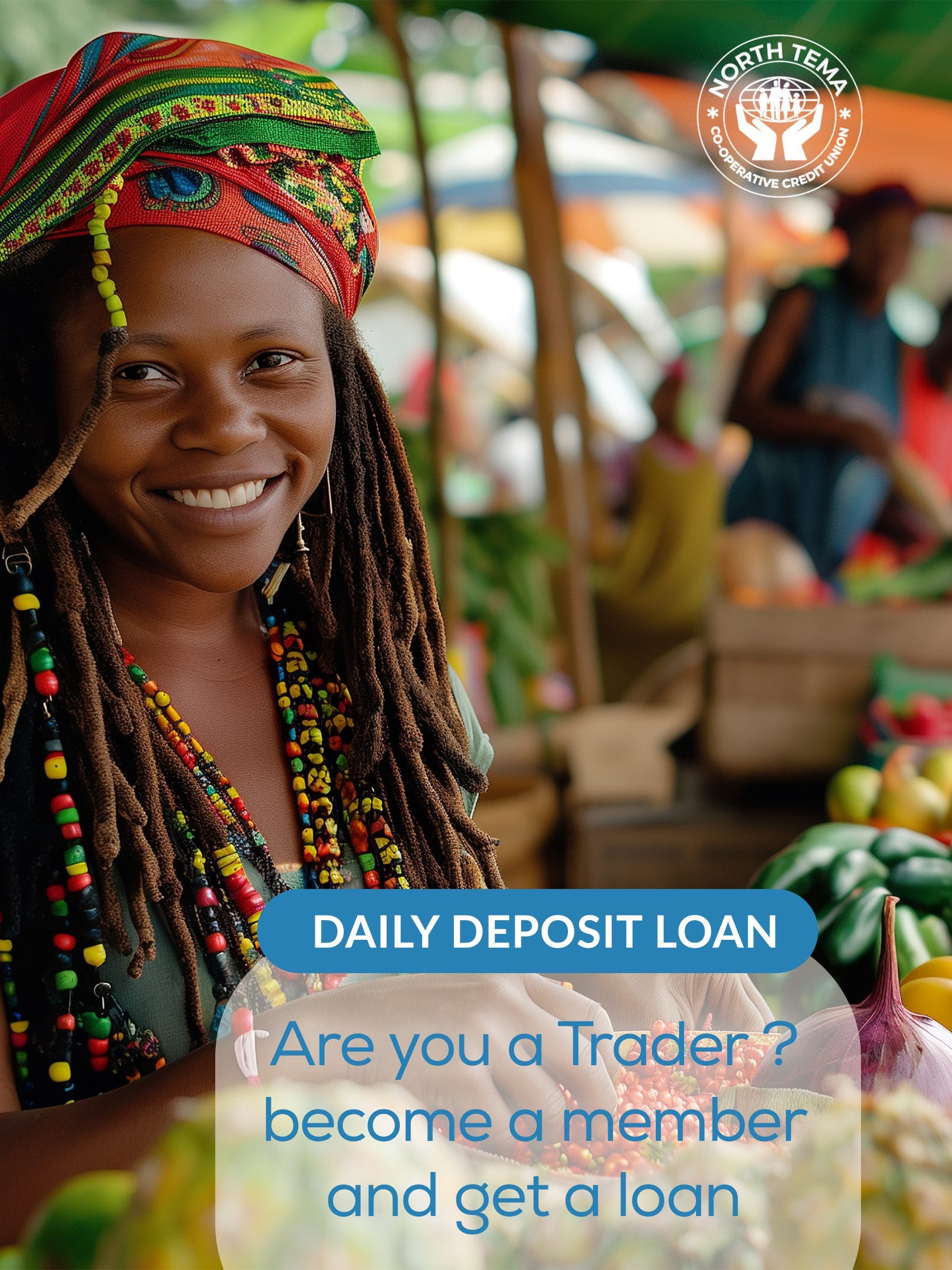

Special Business Loan

The Special Business Loan offers members and non-members the opportunity to grow their businesses with competitive interest rates and flexible repayment terms. This loan is available to various business sectors.